Understanding Insurance Certificates for Cleaning Companies

📌 Managing insurance certificates is a crucial but often overlooked task for commercial cleaning businesses. Whether you’re working with property managers, corporate offices, or government contracts, clients will require proof of insurance before signing agreements.

Failure to track insurance certificates can result in:

✅ Compliance issues that may put your contracts at risk

✅ Missed renewal deadlines, leaving your business uninsured

✅ Potential legal & financial consequences in case of accidents

📋 Keeping your business insured and organized is just as important as having a solid business plan. If you’re just starting or looking to refine your strategy, check out our 📄 Sample Janitorial and Commercial Cleaning Business Plan to ensure your foundation is strong.

In this guide, you’ll learn:

📌 How insurance certificates work for commercial cleaning companies

📌 Why COIs expire & when to renew them

📌 Best methods to track & automate COI management

Let’s dive into how to manage your insurance certificates efficiently to protect your business and maintain client trust!

🔹 Anatomy of a Certificate of Insurance (COI)

Many business owners don’t fully understand what’s on a COI. A visual breakdown will make it easier to grasp.

A Certificate of Insurance (COI) contains essential business insurance details. Below is a labeled breakdown of the key components.

| 📌 Key Component | 📋 Description |

|---|---|

| 🏢 Business Name | The insured company's official name as listed on the policy. |

| 🛡 Coverage Type | Specifies the type of coverage such as General Liability or Workers' Compensation. |

| 🔢 Policy Number | The unique identification number assigned to the insurance policy. |

| 📅 Expiration Date | The date the insurance policy expires and needs renewal. |

| 🏦 Insurance Provider | The name of the insurance company providing the coverage. |

Want to grow your cleaning business the right way?

📄 Download Our Business PlanWhat Is a Certificate of Insurance (COI)?

A Certificate of Insurance (COI) is an official document that proves your cleaning business has valid insurance coverage. It serves as a liability protection tool, ensuring clients that your business is covered in case of property damage, injuries, or accidents. Many commercial cleaning companies must provide a COI before securing contracts to demonstrate compliance with industry standards.

What’s Included in a COI?

A COI contains key details about your insurance coverage, including:

✅ Business Name & Insured Parties – The official name of your cleaning business and any additional insured entities.

✅ Type of Coverage – Specifies whether your policy includes General Liability, Workers’ Compensation, or Commercial Auto Insurance.

✅ Coverage Amounts – Outlines the maximum amount covered by your policy in the event of a claim.

✅ Expiration Date – Shows when the policy expires and must be renewed to maintain coverage.

📌 Why COIs Matter for Cleaning Businesses:

A valid COI helps your cleaning company win contracts by proving you are insured and financially responsible. Many property managers and corporate offices require proof of insurance before hiring a cleaning service.

📢 Plan Your Business for Success: Beyond insurance, a well-structured business plan is key to profitability. Learn how to maximize earnings in the cleaning industry with our guide: How Is a Cleaning Business Profitable?.

How COIs Work in the Cleaning Industry:

📝 Clients Request a COI Before Signing a Contract

- Property managers, corporate offices, and government agencies ask for a COI before hiring a cleaning company.

- Clients may have minimum coverage requirements that cleaning businesses must meet.

🔄 COIs Must Be Renewed Before They Expire

- An expired COI can result in contract termination. Clients need continuous proof of coverage.

- Many cleaning businesses set reminders to renew COIs on time and avoid coverage gaps.

🔍 Some Clients Require Specific Coverage Limits & Endorsements

- Clients may request additional insured endorsements to extend coverage to their business.

- Special contracts may have higher liability coverage limits for compliance.

📜 How to Issue a COI Through an Insurance Provider

- Contact your insurance provider or broker to request a COI for a specific client.

- If the client needs to be listed as an additional insured, your insurer must include this on the certificate.

- Send the COI to the client before starting any work to ensure compliance.

💡 Need Help with Financial Planning? Managing insurance costs is part of running a profitable cleaning business. Use our Cleaning Service Budget Template to plan for insurance expenses and overall business success.

Does a Certificate of Liability Insurance Expire?

🛑 Yes, a Certificate of Insurance (COI) expires when the insurance policy ends. A lapsed COI can put contracts and business relationships at risk, as clients expect ongoing coverage.

COI Expiration Timelines for Cleaning Businesses:

📅 Most Cleaning Business Policies Last 6 to 12 Months

- General Liability and Workers’ Compensation policies typically last for one year before renewal.

- Short-term policies may need renewal every 6 months, depending on the insurer.

⚠️ If a COI Expires, You Must Provide a New One to Maintain Coverage

- Many contracts require continuous proof of insurance, meaning an expired COI could result in:

✅ Loss of contracts due to non-compliance

✅ Delays in client payments until proof of coverage is submitted

✅ Potential legal or financial liability if an incident occurs while uninsured

📌 How to Prevent COI Expiration Issues:

✔ Set up automatic renewal reminders through your insurance provider or digital calendar.

✔ Keep a COI tracker to monitor expiration dates and ensure renewals are processed on time.

✔ Communicate with clients proactively when sending updated COIs to avoid last-minute issues.

💡 Want to Build a Stronger Cleaning Business?

Staying insured is just one aspect of business success.

Still have questions? Contact Us

🔹 FAQ About COIs for Cleaning Companies

Quick reference guide for the most common questions about Certificates of Insurance (COI) in the cleaning industry.

📌 Do I need to send a new COI to clients?

Only if requested, but many clients require annual updates.

📅 Does a COI expire?

Yes, COIs expire when your policy ends. Most cleaning business policies last 6 to 12 months.

🛡 What types of insurance should be included in a COI?

Common coverages include General Liability, Workers' Compensation, and Commercial Auto Insurance.

🔄 How do I renew my COI?

Contact your insurance provider before expiration. Many insurers offer automated renewal options.

📜 Can I issue a COI myself?

No, COIs must be issued by your insurance provider or broker.

Final Summary About Insurance Certificates

Tracking Certificates of Insurance (COIs) is important for commercial cleaning businesses to stay compliant, protect against liability, and maintain strong client relationships. A properly managed COI system ensures that your business never faces unexpected coverage lapses, contract cancellations, or compliance issues.

By understanding how COIs work, knowing when they expire, and setting up an efficient tracking process, you can prevent costly mistakes and streamline your business operations. Whether using manual spreadsheets or automated tracking software, having a structured approach to COI management will save you time and reduce risks.

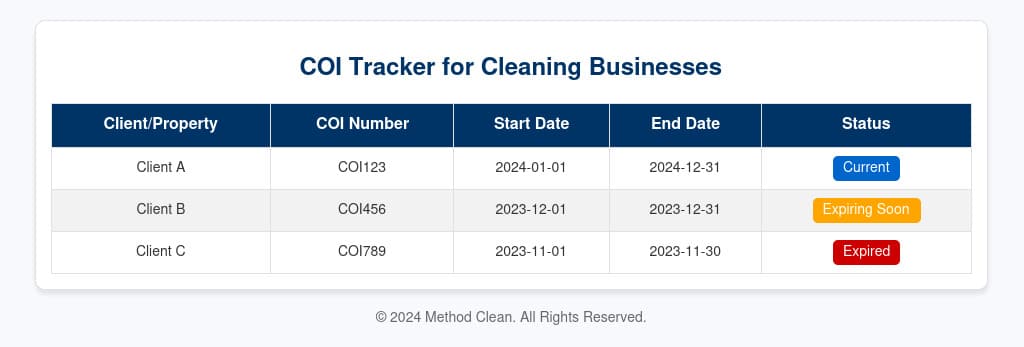

If you’re looking for a simple way to organize and track your COIs, download our COI Tracker today. It’s designed specifically for cleaning businesses to help you monitor expiration dates, store certificates, and automate renewal reminders.

📥 Download Your COI Tracker Now and take control of your insurance management!

By staying proactive with your COI tracking, you ensure your cleaning business remains secure, professional, and always ready for new opportunities. 🚀

📄 Download Your COI Tracker

Easily track your Certificates of Insurance and stay compliant.

Get instant access to our **free COI Tracker** designed for cleaning businesses. Keep your insurance details organized and never miss a renewal deadline!

📥 Download Now